Customer expectations for convenience and speed have spiked in recent years, even for the insurance industry. Deloitte reports that 95% of insurance agencies are “already accelerating or looking to speed up digital transformation to maintain resilience.” Although every department is involved, marketing plays a critical role in this transformation of the customer journey.

Read on to discover eight marketing tools and templates you can use to win and retain modern insurance customers.

1. Optimize your Google My Business listing.

Your reputation on Google matters. 70% of insurance shoppers begin with a Google search. The first few results in the Google Map Pack are Google My Business listings in the area with the best, most recent, and highest quantity of Google reviews.

Aside from reviews, an updated listing is crucial to gaining trust from potential customers. To get started, search for your business on Google. If your listing already exists, claim it and confirm/update information like your website, phone number, services, address, pictures, and business hours. If your listing doesn’t appear on Google Maps, add your listing through Google My Business.

This simple tip can help you stand out from the competition and be chosen by future customers.

2. Convert your landline to a textable number.

Another way to improve your Google listing is to add a textable number through Apple Business Chat or Google Messages. Half of insurance-related searches come from mobile devices anyway, and 90% of customers prefer communicating with businesses via text.

Right from a customer’s initial interaction with your brand, they can immediately contact you to request quotes, get more info, or set up appointments. The click-to-text feature is convenient for customers and helpful for staff, leading to fewer phone calls and quicker steps through the conversion funnel without hassles like waiting on hold or in-person visits to sign documents.

While some responses can be automated (answers to FAQs, appointment scheduling, etc.), texting can also be a convenient way for current customers to connect with an agent and renew a policy or add new policyholders.

For example:

Customer: Here’s the info for the new car we’re adding to our plan. (picture of license and VIN number)

Agent: Thank you so much! We’ve added to the system and you’re good to go!

3. Implement web chat on your website.

Early on in the conversion funnel, customers are looking for key information to help them make a purchasing decision. While customers place a lot of trust in agents and staff, not every inquiry requires a human response. Particularly in the research and consideration phase, chatbots and artificial intelligence are ideal for answering FAQs, serving as a website directory, and assisting customers with their concerns in real time, 24/7.

Webchat can also serve to connect customers with agents when they’re ready to convert, not just when they’re looking for more info. When making claims, 49% of customers prefer talking with an advisor in-person (or perhaps via video chat) rather than handling emails, phone calls, or chat bots. But for other key touch points such as requesting quotes and directing customers to the appropriate services, web chat can greatly assist customers through to conversion.

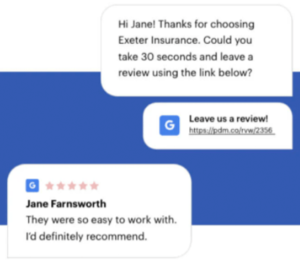

4. Automate review asks via text.

Positive reviews boost your ranking in search results and direct qualified leads your way. But the quantity of reviews you’re after will not come without effort. The tried-and-true best practice for collecting reviews speedily is through text messages. At a natural point in the customer journey, perhaps after renewing a policy, automate a review request to be sent to your customer via text.

Emails tend to be filtered, snail mail is ignored, and signs in your office may not be personal or direct enough. But texting is preferred by customers and has nearly 100% open rates within 3 minutes of delivery. Automate the process and collect reviews the way that works—texting.

In addition to requesting reviews, be sure to respond to each and every review, whether positive or negative. 96% of customers who read reviews also read your responses. Taking time to acknowledge the feedback you receive and address areas of improvement will prove to customers that you care and that you operate transparently with your customers.

5. Implement a referral program.

Word-of-mouth marketing should be a priority for any business trying to grow. Insurance, in particular, is usually purchased by recommendation—through online reviews or personal recommendations. Customers are giving and asking for recommendations (online and from friends) anyways. Implementing a referral program can help your agency and your customers tap into the benefits of something that’s already taking place. Determine the parameters of your referral program, inform customers how it works, and watch your customer base grow.

In addition to current customers, you might consider reaching out to other local businesses (mortgage companies, realtors, car dealerships, etc.) to raise awareness of your services and draw in more referrals. You can build relationships with local brands overtime via social media, community events, newsletters, and other collaborations.

6. Personalize your offers.

88% of insurance consumers are looking for more personalization in insurance. This could indicate that insurance companies are not truly aware of what customers want. Recent research by McKinsey shows that digitally smart insurance companies that personalize their offers through continuous improvement of the customer experience convert 6x more customers online.

You can personalize your offers in several ways: use cookies and analytics (like bounce rates, conversion rates, time per browser session, etc.) from your website to learn the demographics of your audience and evaluate their purchasing behaviors. You can also collect feedback via text surveys to evaluate customer satisfaction and gather suggestions to simplify the customer journey and eliminate pain points. Another important factor in personalizing your offers is to use customers’ preferred names in your marketing communications such as follow up emails or texts. This is not hard to do, yet adds a personal touch that many companies miss.

7. Pay for advertising.

Even with many “free” resources like review sites, content marketing, and word-of-mouth referrals, paid advertising can go the extra mile to reach targeted audiences. A J.D. Power survey found that “brands recalled by shoppers on an unaided basis are four times more likely to be quoted than brands only recognized on an aided basis.” Extensive, memorable marketing campaigns through social media, television, and Google Ads, contribute to customers’ perceptions of your brand’s convenience and leadership.

Before increasing your ad spend, be sure to segment your target audience and analyze lead sources to know where to invest your marketing budget.

8. Manage inward communications.

Although customer interactions are managed by different teams and departments (customer service, call centers, sales, marketing, underwriting, claims, agents, etc.) with varying goals and metrics, the customer doesn’t think in these separated terms. Customers don’t necessarily see all the moving parts and they don’t want to, either. It’s your job to create seamless experiences for insurance customers throughout the entire journey.

It’s hard to do this without communicating with all parties involved, including remote and on-sight employees. Efficient teamwork and collaboration within your company and across various departments will aid you in creating better customer experiences. See how Teamchat, Podium’s internal communication feature can help as you manage customer interactions.

Watch a free demo to see how Podium can help you improve marketing results by collecting reviews, managing leads, and facilitating internal communications from one central inbox.