To become a leading financial institution in your area, you have to stay five steps ahead of the competition. But how? The fact of the matter is that a flooded market has little room for expansion.

That’s why it’s a top priority to do things that help your bank and local branches to stand out, like a neon flashing sore thumb. Bank marketing can be challenging in this day and age, especially when the landscape is continuously changing for financial institutions.

Don’t worry, we’ve got you covered. Here we will highlight the top seven bank marketing strategies to help your bank branch beat the local competition with your eyes closed.

1. Make customer experience a top priority for your financial institution

Nothing is going to set you apart from the competition if you don’t provide phenomenal customer service. Obviously, right? Well, sometimes that can be easier said than done.

Working with people and their finances can be very rewarding, but it can also be difficult at times. However, if you put the customer experience above all else, everything beyond that will fall into place.

We understand that it is a tall order with all the means of engagement nowadays with the advent of digital marketing. But it is critical to provide bang-up customer services everywhere from your local branch to your social media.

Take a page out of td bank’s book, recently named J.D. Power and associates’ top financial institutions for customer service.

Graded on various banking criteria such as convenience, availability of banking services, channel interactions, and problem-solving. TD received top marks for providing ‘consistent customer experiences across all accounts.’

This just goes to show that consistency in quality service is paramount to a good marketing strategy.

2. Do your research before you do bank marketing

Second only to providing a great customer experience, you need to do your homework. See what other local banks are offering. How will you know how to beat the competition if you don’t even know what they are doing?

It should be stated, don’t throw together a marketing strategy with assumptions. There are simply too many variables to account for. Don’t make guesses. Speculations on what your competitors are offering can be a big downfall.

A great example of this is a bank from the land down under, commonwealth bank.

They did their research and found that the people in their community wanted more access to mobile banking. The competitor’s offering for mobile access was lacking. Commonwealth discovered the immediate customer problem and delivered top-notch mobile features as a solution.

3. Demographic targeting – who are your consumers?

Is what you are offering, even appealing to your target audience? Put in the time and energy to get to know your ideal demographic. There’s no other way to cater your content marketing and offerings to resonate with potential customers.

After doing your homework to define your target audience, it’s time to put that knowledge to work. Put together marketing that is hyper-targeted toward the people in the community you are trying to reach. Working on a smaller, local scale should make this simple enough.

Let’s say you are a local branch in a major city, and the folks you are trying to reach are millennials. There are about seventy-three million millennials in the US. They are the main population of your community and need flexible financing options. With that data, you can develop a pointed marketing campaign.

A great example of this is Citi Entertainment.

Citi bank has fully embraced its key demographic and knows what they want.—Entertainment. So they entirely pivoted to cater to their bank brand accordingly.

4. Stand out amongst other competing banks

Nearly everyone needs a bank account; why not stand out by offering your potential members a reason to choose you over the competitor. Does the competition offer extensive information for folks looking for financial advice and guidance? Probably not, and if they do, you can do it better.

These types of programs help focus on customer outreach. An informed consumer is a happy consumer. Plus, it gives you one more touchpoint that emphasizes your dedication to the customer experience.

One local new mexico bank that nailed this strategy is Centinel Bank of Taos. They go above and beyond with not only extensive online education articles but also presentations and community workshops.

Offer classes in-house to fully engage with the c and show off your stellar in-house customer service. Customer outreach and community engagement are big hitters in local bank marketing strategy.

5. Tell an inspiring story to your customers

Tell the story of your community. Brand storytelling is a fantastic way to generate content and captivate your local target audience.

Everyone loves a heartwarming tale. Is your branch’s founder from nearby? Put together some ads that talk about how they grew up in the community and how they strive to improve it.

Highlight how your bank’s branch fits into the narrative of a tight-knit town with local financial success stories. Like the bank of elk river, who won “best in show” in 2018 for their video that chronicles the tale of a family buying their dream home.

Not only does this type of storytelling solidify your place in the community, but it also helps people visualize themselves as those homeowners who couldn’t be happier in their perfect home and how your local branch can get them there.

6. Utilize video marketing in your digital marketing strategy

On that note, you really should try videos! They are a great way to convey a ton of information in an engaging format within a short period of time. Most people would rather watch a video than read a whole blog post and there are options with the right software for banks that you can use to generate these videos.

Perhaps try taking some of the curricula from the educational courses you offer and turn them into little tutorial videos. It sounds crazy, but your bank should have a youtube page as it is the 2nd biggest search engine in the united states, comprised of tons of videos.

One bank that is absolutely knocking out of the park is Silicon Valley Bank. Surprise! A bank in the heart of tech land has fantastic videos. Who would have guessed? That’s killer demographic targeting if we’ve ever seen it.

Your main goal is to get your branch a lot of attention. Using videos on any platform and partnering with influencers can help you do that. Svb has nearly ten thousand subscribers. We’d say that’s a lot of attention.

7. Implement the latest bank marketing technologies

We know this is a rather broad statement. Especially in the day and age, there are a billion tech platforms to choose from. However, not every solution is going to fit your local branch’s needs. Financial tech options are wide-ranging.

One big suggestion is to go with the avenues that will cater to the people using it. That’s likely going to be gen zs and millennials. It’s just a fact they are the largest demographic looking for flexible mobile options and are simply more digitally inclined.

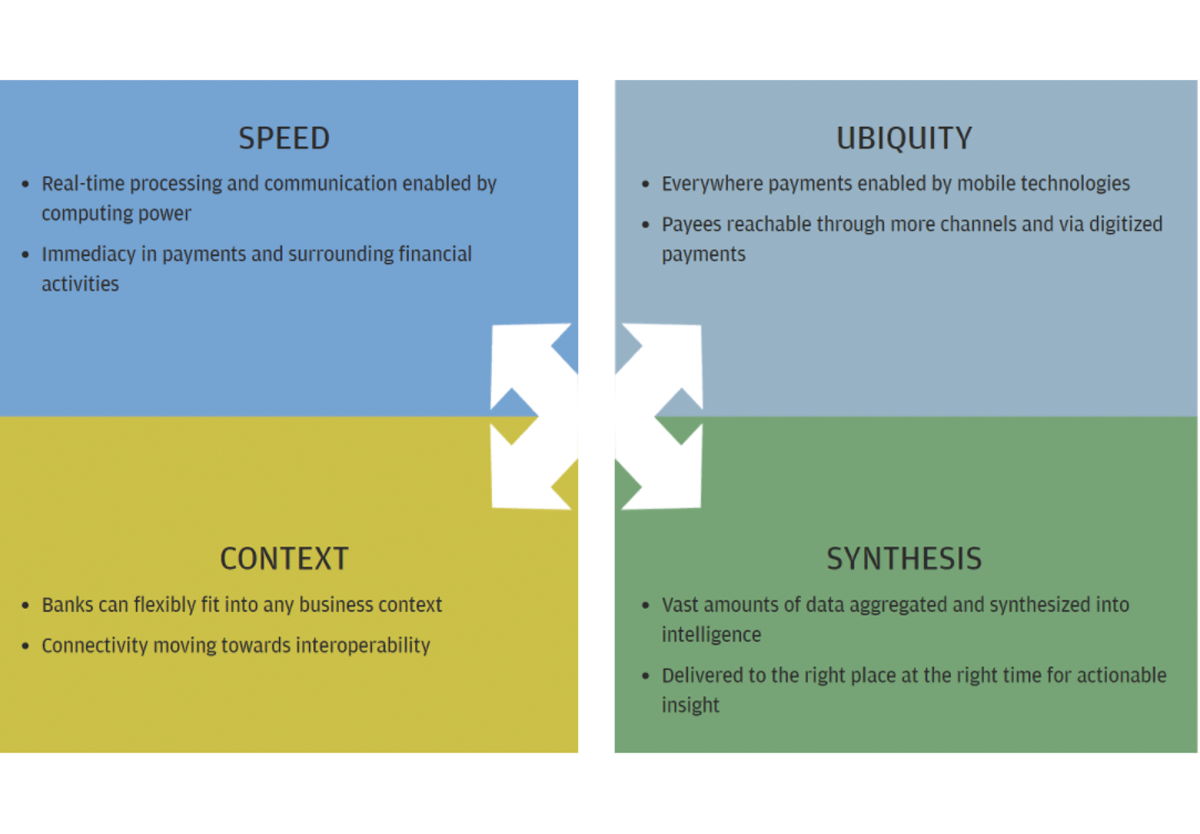

In 2019 j.P. Morgan was named for the best tech overhaul. They tackled all the major points, connectivity, ease of use/mobility, and data integration.

To keep up with the latest generation of users, try something like Podium. It’s one of the best options for communication software. With tools for messaging, keeping track of your online reviews, and also features lead generation tools.

Blow the competition out of the water when marketing your bank

We know it can be a big project to set your branch apart from the local competition, but—congratulations! After reading this article, you are one step closer to taking your bank to the next level.

Don’t underestimate how important it is to do your homework on your competition and your customers. What is lacking, and how can you make it better? And who are you making it better for?

Focus vigorously on your customer’s experience so they wouldn’t dream of taking their business elsewhere. You can do that by adding value to your bank with excellent education programs.

Also, remember that people like hearing inspiring stories. Weave a tale that puts your branch front and center of the story. Try doing this with videos. And last but certainly not least, utilize technology to connect with those you serve in the community.

Marketing your local bank branch requires adaptability and innovation. And that can be tough in an ever-evolving world. Once you implement these seven strategies, you will foster a greater sense of connection and trust with your customers, thus setting your branch apart so you shine brighter than the rest.

Get started today with Podium for free.