The US Government has responded to one of the largest shocks to local businesses in history by passing a $2.2 trillion stimulus package that has a large portion dedicated to giving stability to the local economy. With a fund of $357 billion dedicated for local business, it can provide relief, and in several cases forgivable relief, for items such as employee payroll, rent, accounts payable and other items to keep their business intact through the disruption.

With a program so large, here is a breakdown of how the package potentially impacts you and your business as well as some of the best tips to maintain financial stability over the next stretch of time. Many of these plans are in progress. Keep an eye out for additional content on podium.com/covid that will give you details on how to apply and receive these benefits as they are rolling out in the days and weeks to come.

Current payables and payroll stability through forgivable Small Business Administration (SBA) loans

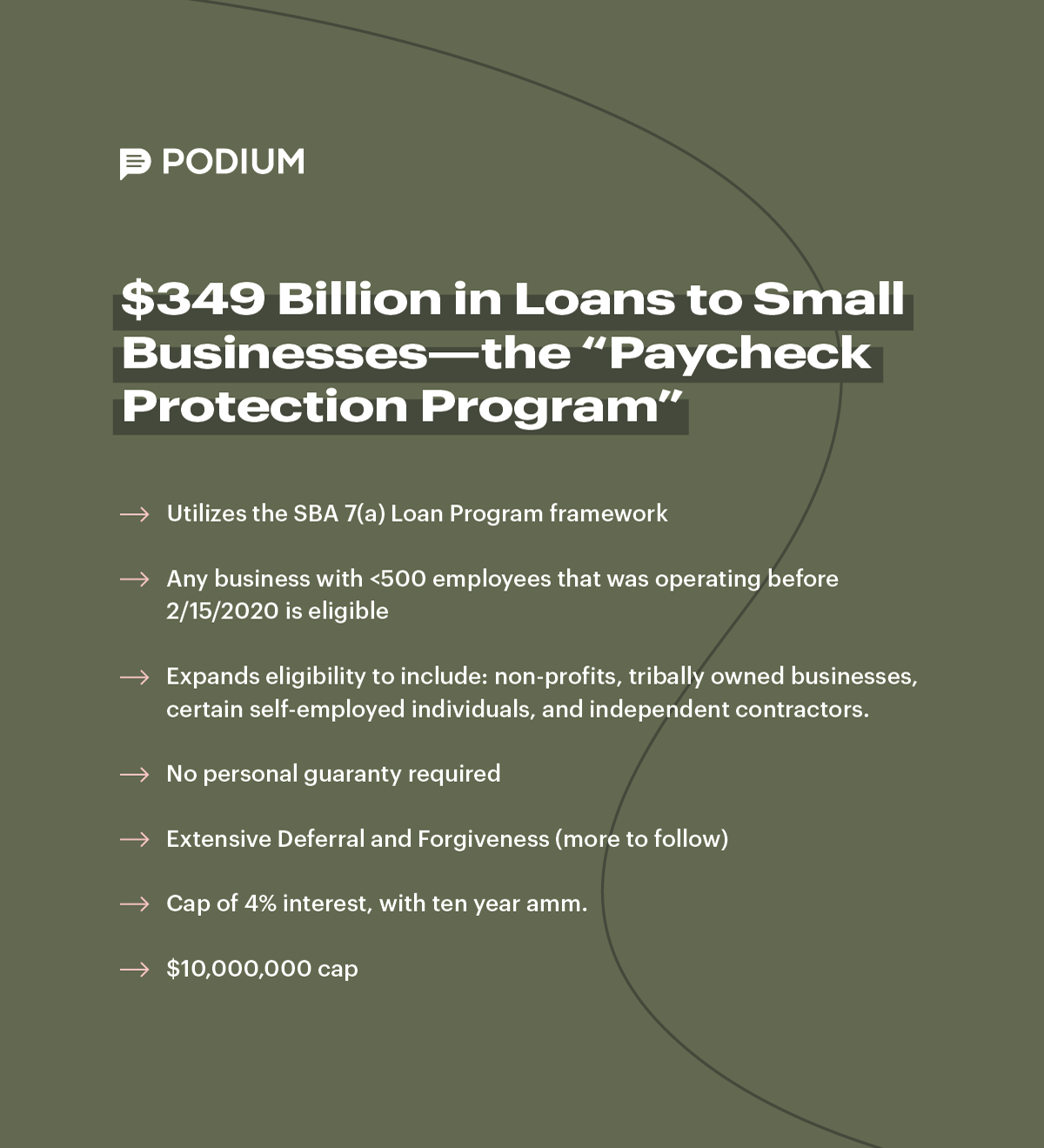

Many of the plans in the past weeks, including the $367 billion reserved for small businesses in the relief package, are geared towards giving these businesses an increased level of stability in the short-term. The largest element in this package for local businesses is a forgivable loan program that allows businesses to borrow up to $10 million to cover the business costs during the crisis. The overall framework follows the SBA 7(a) loan program, which allows businesses up to 500 employees to get up to $10 million in loans via the SBA and its partner lending institutions. The government is expanding the network of lenders to hasten the payout on these loans. The formula that you can use to calculate the amount is based now on 2.5x monthly payroll cost. There are still details to emerge on how to calculate this, but it’s likely to be an average of the past three to four months. So, if a company has 100 employees at $120k each, then it is eligible for $2.5M. This can be used to pay essentially any operating expenses.

Even better, portions of the loan will be forgiven if you hold on to your workforce, under a formula that is very beneficial to local businesses. The way to do this is to compare the average number of employees you had in the next 8 weeks versus the average number you had from Feb 15, 2019 to June 30, 2019. The loan will be forgiven in an amount up to this ratio. So if the ratio is 1:1 or more, the entire loan is forgiven. One thing to keep in mind is that this forgiveness is reduced by any reduction in wages for employees making less than $100k that exceeds 25% of compensation. As of now, it does not appear that there is any personal guarantee for these loans.

There is also a separate 100% refundable tax credit for employers with fewer than 500 employees to provide two weeks of paid sick leave and up to twelve weeks of paid family and medical leave for employees affected by COVID-19 through December 31, 2020. The maximum amount of an employee’s wages required to be paid and eligible for the credit is $511 per day. The credit limitation is $200 per day for employees taking leave to care for a family member impacted by coronavirus or a child if his or her school was closed due to the health emergency. These credits will offset payroll tax obligations and are also refundable for firms without profits or current tax liabilities. This is law now and can immediately be implemented into your financial strategy.

Read more here:

We will follow up with additional tutorials with the application process as it becomes available.

Deferring Payroll Tax

Another feature that is contained in the relief package is that employers can defer paying payroll tax. Employers are generally required to pay 6.2% in Social Security taxes on workers’ wages up to $137,700. The COVID-19 relief package allows these tax payments to be deferred through the end of the year, with half of the deferred payments due by the end of 2021 and the other half by the end of 2022. This should free up some capital at companies through the crisis. For instance, a company with 100 employees making $75k will have about $350k in payroll taxes eligible for this deferral.

In addition, companies who have seen gross receipts fall by more than 50% in the business quarter when compared with the same quarter the previous year, there is a refundable credit of 50% of wages paid up to a total of $10k per employee. Companies that use this credit cannot access the new COVID Relief Package small business lending facility.

Larger Local Business Relief

For companies with 500 employees or more, there is a Federal Reserve “main street lending facility” and Treasury “mid-size business lending-facility.” Details are still emerging on these plans. The most recent information shows that this will be operated under the Treasury. These loans will have rates capped at 2% and have a required six month grace period before repayment for companies that retain 90% or more of their workforce and restore compensation to 90% of levels as of February 1, 2020 within four months after the declared end of the health emergency.

Disaster SBA Loans

The SBA is working directly with state Governors to provide targeted, low-interest loans to small businesses and non-profits that have been severely impacted by the Coronavirus (COVID-19). The SBA’s Economic Injury Disaster Loan program provides small businesses with working capital loans of up to $2 million that can provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing

Small business owners in all U.S. states and territories are currently eligible to apply for a low-interest loan due to Coronavirus (COVID-19).

There are typically four requirements for businesses to be eligible for these loans:

- Location – As noted above, “business owners in all U.S. states and territories are currently eligible”

- Credit Requirements – The SBA will perform a routine credit check on your business

- Repayment – The ability of your business to repay the loan

- Collateral – For loans larger than $20,000-$25,000, the lender will most likely require some sort of collateral

Applicants are encouraged to apply online for a disaster loan. If you do not have access to a computer or smartphone, please call the SBA at 1‐800‐659‐2955 for assistance.

- Items needed to submit an application :

- SBA Form 5 (Business Loan Application)

- IRS Form 4506-T (IRS Release)

- Most recent Federal income tax returns

- SBA Form 413 (Personal Financial Statement)

- Schedule of Liabilities (may use SBA Form 2202)

- Additional documentation may be requested, such as income statements, deed/lease information, Employee Identification Number (EIN), monthly sales, etc.

If approved, businesses can use the proceeds of this loan for:

- Fixed Debts

- Payroll

- Accounts Payable

- Invoices

As more information comes out on each of these programs, Podium will be posting more articles that can take you through the process of each of these programs as they come online. Please continue to refer to podium.com/covid for ongoing coverage.