7 Review Marketing Tips to Start a Credit Union

Part of owning a small business is understanding the various processes behind the scenes, like review marketing. This can be especially challenging when you are looking to start a new business, such as a credit union.

Choosing to start a credit union is more involved than starting another type of business, such as retailing, due to the many regulations. This can make it hard to figure out where to start. To make matters more challenging, it is hard to find a comprehensive page that outlines all the steps in the process.

That said, many people have successfully started credit unions. To date, the world has more than 46,000 credit unions with around 172 million total members. In America alone, about 90 million people belong to credit unions.

To help you start a credit union, we’ve outlined the most important steps in the process, along with some crucial tips to help you along the way.

What to Consider Before Starting a Credit Union

As with any other business, you don’t want to rush into starting a credit union. You need to take the time to evaluate whether it is a good idea and figure out the specifics about it.

1. Look at Demand

Start by exploring the demand for a credit union in your area. Remember that credit unions are owned by their members. As such, you must have demand. Without demand, there will not be enough owners to create the union.

On the other hand, when you have enough demand for a credit union, you should be able to easily find plenty of members. Many will likely join as soon as they hear about the union. Others will likely join as the result of review marketing.

2. Establish Commonality

Once you have confirmed there is a demand, think about what commonality the people who want a credit union have. This can be a geographic group, a religious group, an educational group, an industry, a workplace, or any other type of group that makes sense. The commonality is also called the common bond or field of membership.

The need for commonality or “common bond” comes from the history of credit unions. They were historically based in communities with common geographic bonds. This lets the community monitor the financial responsibility of members.

Before choosing a commonality, remember to confirm that there is enough demand within that group. You don’t want to appeal to a specific group if that will not leave you with enough members for a successful credit union.

Once you decide on the commonality, take it a step further. Think about the unique needs of this group and how you plan to serve them. This will be crucial for your review marketing and other advertising later on.

Steps to Setting Up Your Credit Union Correctly

When you are ready to start setting up the credit union, you want to take the time to do it right. Remember that it is easier to go slow and do things correctly the first time instead of rushing and correcting errors later. This is especially true with credit unions, as some specific steps will depend on your country, state, and even city or county.

3. Decide How to Structure Your Credit Union

Start by figuring out whether you want your credit union to be basic or full-service. With a basic credit union, you will just have checking and savings accounts plus small consumer loans. Full-service credit unions will offer retirement accounts, check cashing, business loans, and other advanced services that clients expect from a financial institution.

There will be significantly lower costs associated with starting a basic credit union. However, you will also offer fewer services. This may make it harder to gain members or to make a profit. That said, the lower start-up costs make basic credit unions much more popular, at least in the early stages. You can eventually grow your credit union and expand its offerings.

You will have to think about your business and plans to decide which structure makes more sense for you. Your decision will also likely depend on what the people in your commonality group need. This is part of the reason it is so important to research the commonality and demand ahead of time.

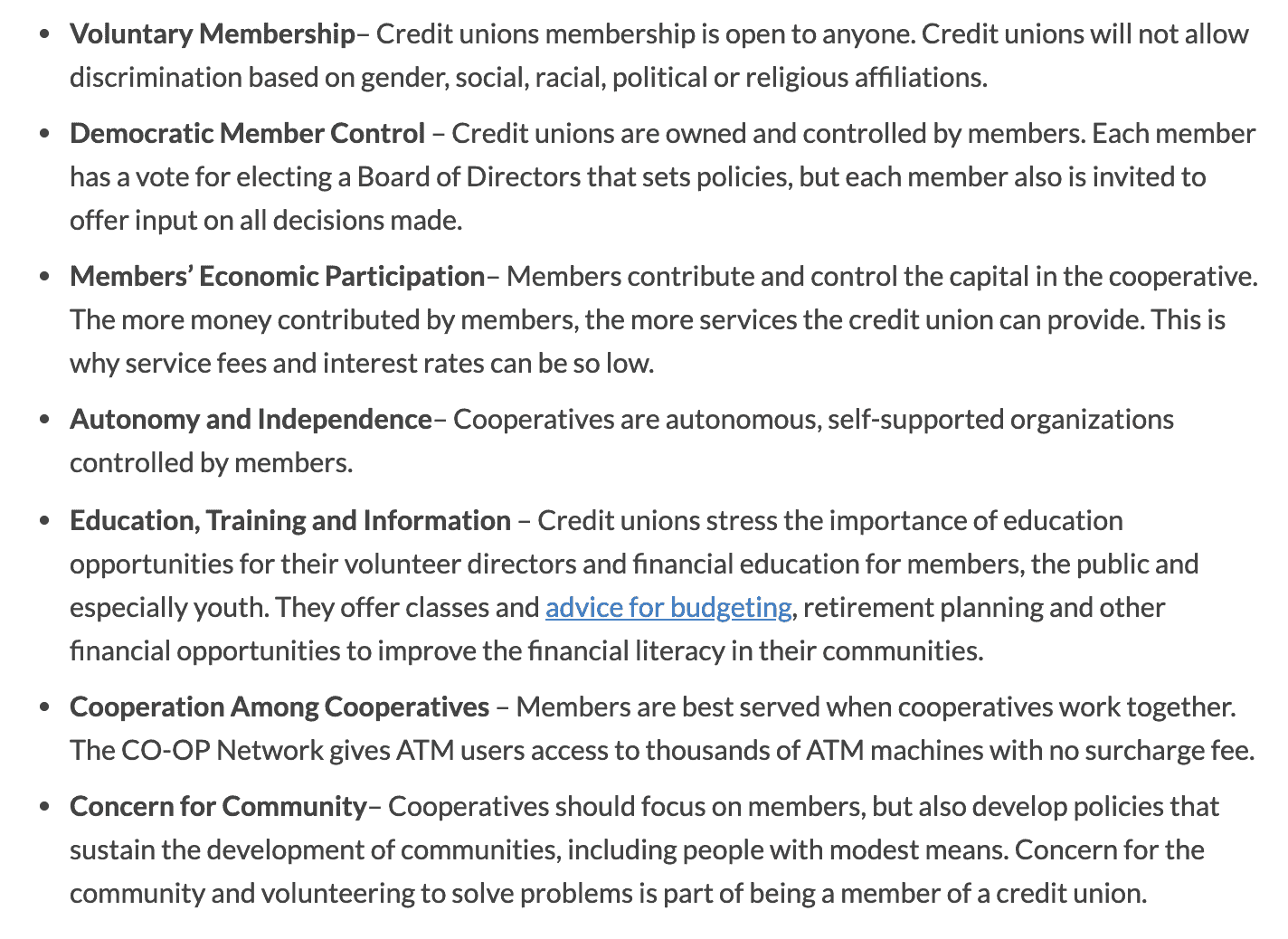

The following shows some principles of credit unions that highlight the importance of finding commonality.

Essentially, credit unions are run by their members. As such, you need to make sure that yours is set up to meet the needs of your clients.

4. Create a Business Plan

Next, you will have to create a business plan. This should be incredibly thorough and well-thought-out. You do not want to just throw a business plan together in a day or a matter of hours.

Remember that clients will look at your business plan to decide whether they want to trust you with their money. As such, your plan should show forethought and planning.

A typical business plan should include the following major categories:

The following list gives you more detail about what to include:

- Your chosen name (plus an alternative)

- Common bonds

- Market overview and size

- Current assets (including the source of the funding)

- The subscribers (who prepares the charter application)

- Plans for growth

- Financial plans

- Startup costs (including office rental space, staff, and office equipment)

- Organizational plans

- Competitive analysis

- Intended location(s)

- Customer survey data

5. Contact the National Small Credit Union Program (NSCUP) for a Charter

To operate a credit union, you will need to get an official charter. In the United States, this is from the National Small Credit Union Program (NSCUP). The good news is that the NSCUP will give you direct assistance to start your credit union. This can include:

- Technical assistance

- Training assistance

- Best practices standards

You will also get a series of checklists and worksheets from the NSCUP, all designed to make setting up the credit union easier.

If your potential members have low income, you can request a low-income credit union designation from the NSCUP.

To make the process of chartering with the NSCUP easier, it is best to hire qualified management staff. They can help with the marketing plan, business plan, and chartering form. You can also complete the process yourself with some tools from the NSCUP. For example, they offer a Chartering Proof of Concept tool. That automated system helps you understand how to apply for a charter and how to prepare your application.

The NSCUP also provides resources to help you grow your credit union in the future, from templates for expansion business plans and marketing plans to financial templates.

You’re Chartered! Now It’s Time to Start It Up

After you receive your charter from NSCUP, you can get to work starting the credit union. Starting up quickly tends to be the most cost-effective method. The sooner your business is running, the sooner you can start paying for the overhead costs.

6. Hire the Necessary Staff

One of the first steps is to hire your staff. To figure out which positions you should hire for first, look back at your business plan, specifically the organizational section. Start signing people for the essential positions.

As you hire staff, try to choose each person with care. This is important as the initial hires will have a large influence on your company’s overall culture as it grows.

Start with major management staff to help run the credit union. But don’t forget the smaller roles, such as tellers, as these are essential to day-to-day operations.

7. Get Off to the Races (Start Signing Clients)

You hopefully already established your commonality before you got started. Now is the time to reach out to the people in that commonality group. Start by working to gain the trust of that group, if you haven’t already done so. From there, you can start signing clients.

As you start getting clients, take advantage of review marketing. Encourage clients to leave reviews about your credit union, as these will help build your reputation and attract new clients.

Conclusion – Why Review Marketing Is Important for Starting a Credit Union

Starting a credit union does not have to be overly intimidating. As long as you do research to confirm the demand for one and set it up properly with a well-thought-out business plan, you should be on your way to success.

Throughout the process of starting the union, take advantage of technology to make the most of your efforts. For example, you can incorporate Podium Reviews into your review marketing. Or use Webchat to capture leads from potential clients who visit your website. When combined with proper planning and the above tips, these tools should set you up for success.