You’re in business to make money, and the way you make money is to loan money. To be as streamlined and efficient as possible, you want to take advantage of the best LOS systems available. Loan Origination Systems is the name for programs designed specifically for loan origination applications.

Loan origination software helps streamline the process and cut through the process as quickly as possible without missing essential items. You’ll be able to manage documents and save time for yourself and your borrowers. When used in a full LOS system, LOS software can manage various loan origination processes.

Find the Loan Origination Software that’s best for you, and can help you convert more. We’ve made it easy and compiled a list of the best software choices on the market right now. Find the option that works best for you, and don’t forget to check out the bonus freebie at the end of the list.

Loan Origination Software From A to Z

Bryt

Bryt software allows you to determine the order of documents needing completion, ensuring compliance at all times. Send borrowers the right documents at the right time. You’ll stay organized from start to finish with each loan. You get to use your documents and paperwork, which streamlines with all the processes that you’ve already had in place for years. There is no significant learning curve. The interface is simple, user-friendly, and will help you and your borrowers feel at ease instantly. You’ll create your portal, customizable in color, and layout. The Customer Relationship Tool will keep track of every single communication between you and a customer, including notes and logs. It couldn’t be easier or more organized.

C2 Covalent

This is a cloud-based loan origination solution. That means there is nothing to download and slow down your laptop or desktop computer. No more IT headaches and worries about compatible software. If your systems can access the internet, you can access these types of software systems. C2 Covalent design is exclusively for banks and credit unions. It completely automates the processing of loans. It has built-in all the state and local regulations, making compliance a snap. You will also be pleased to see that you can do everything digitally, right down to signing the loan documents. Because it is a cloud-based platform, your employees can access the software from any terminal, laptop, or desktop. This feature is incredibly convenient, especially for growing businesses.

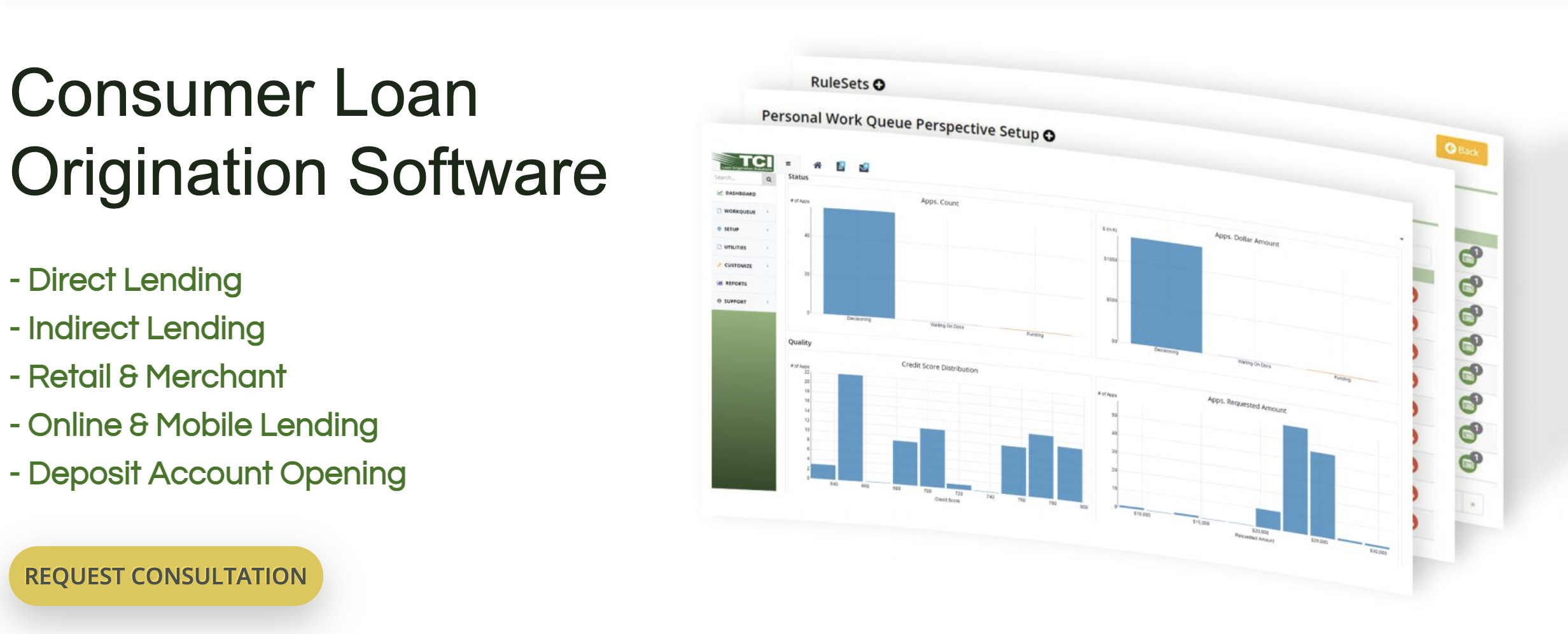

Decision Lender Software

Decision Lender helps you with direct, indirect, and online lending. This is also an online, cloud-based loan origination solution to help you with digital loans and more. The mortgage industry has changed to meet its market where they are at home. More people than ever before are applying for loans from the comfort of their sofas and kitchen tables. This software was built with that in mind. One of the best points of this software is using your lending forms and paperwork. Upload them and use them as if you were working with a walk-in. It boasts a fantastic rules engine that doesn’t stop at loan origination but can follow the process through approval and account opening.

Defi Solutions

This loan origination software solution was created by lenders for lenders. Who knows better what you need and when you need it? Fully configurable – create your documents and determine which ones you need first. This software’s design is for speed and reliability. The performance is scalable for small applications or enterprise loan companies and banks. It’s up to you. This is a system that can grow with you. Built for compliance and security, keep your documents in order, and keep your borrowers’ information secure at all times. Security is critical when you’re using cloud-based systems. You want to ensure that your members are using the latest security to ensure personal information is kept as safe as possible at all times. So, trust software that secures private information through alerts when security issues arise.

Encompass Software

Powered by Ellie Mae, it boasts that you’ll see an immediate ROI and operational improvements. They’ve created a platform to provide you with all the support you’ll need across several different lending platforms. Ahead of the digital lending curve, this has everything for all loan officers in one convenient place. Everything needed to process a loan can be found in one seamless location. This makes the process smooth and far quicker than the old days of pushing paperwork across desks and setting up face to face appointments.

FileInvite

Getting the documents you need promptly is the biggest hassle of all when you’re in the loan origination business. Everyone knows it’s a pain, and that’s why FileInvite has made that a problem of the past. No more issues with emails bouncing back to you or files not sending because they are too big. Now, it’s all done through their platform, in the right order. You can invite borrowers to fill out documents via email or even text message. More people use cell phones than computers, so that makes this a huge advantage.

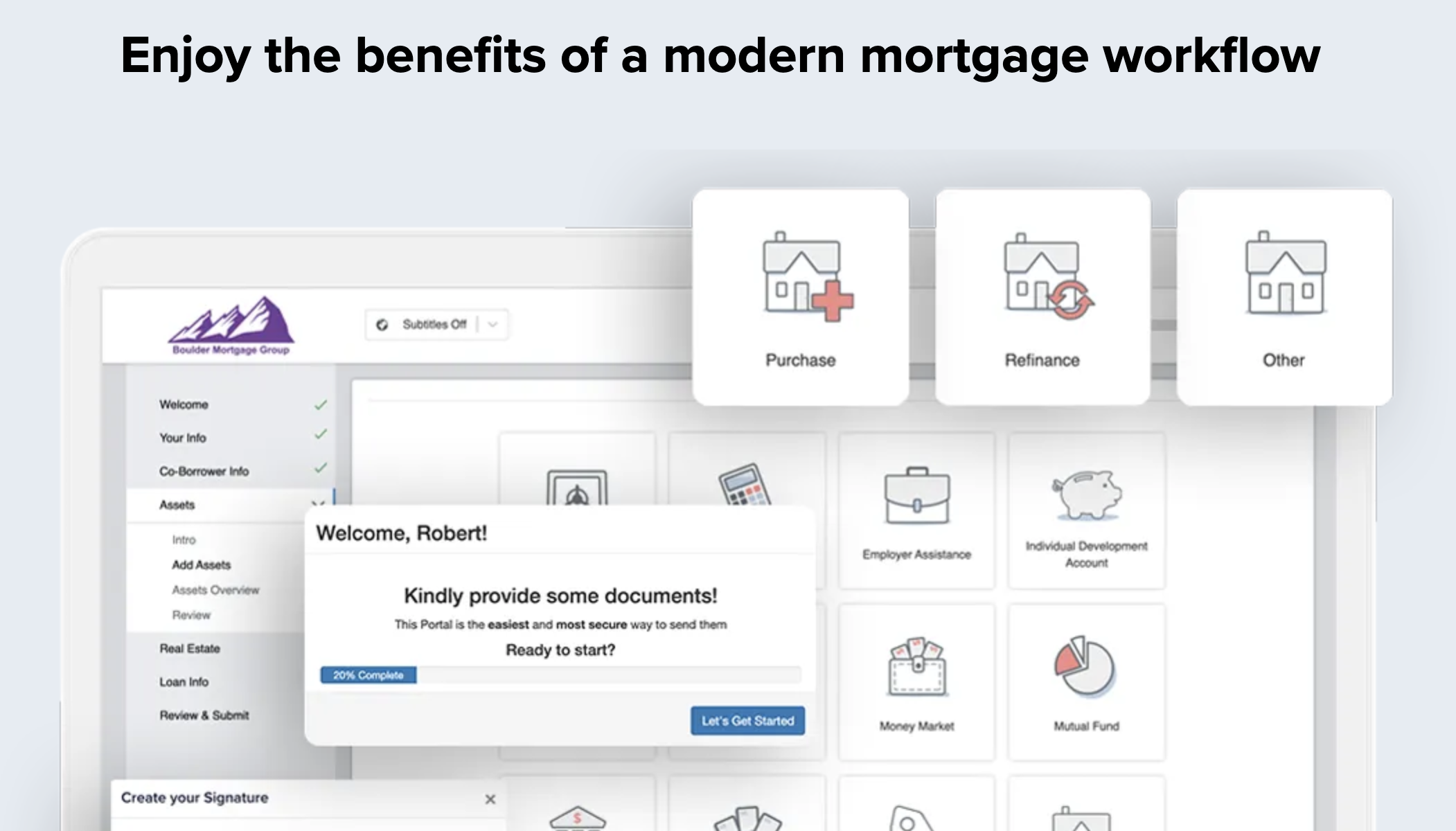

Floify

Collect more documents efficiently and never worry about getting documents back ever again. This software will virtually do the work for you. This web-based application has a friendly user interface that guides them step by step through each document. You can customize your web portal with your colors and designs and even add Spanish subtitles where necessary. Try a free demo.

FNI Blueprint

FNI has put together a fantastic intuitive software that enhances the user’s experience, making it simple and accurate. This simplicity helps on your end as you’ll always have the right paperwork filled out correctly. You’ll have your portal with a dashboard that you can access from a computer, a tablet, or a cell phone—when you’re on the go. They utilize proprietary software for their engine that will provide you with loan feedback and credit decisions quickly.

Lending Pad

Another of the cloud-based systems, but there’s nothing to download. No headaches and be up and running the same day. Lending Pad boasts no limit on the number of users. That’s a big plus if you’ve got a vast number of offices and loan officers who are all using the platform simultaneously. Most importantly, this software meets SSAE16 SOC2 Type 2 Security Audit standards. Your borrowers’ information is the top priority, and only world-class security is good enough. The icing on this cake is that you can reduce your production time by 50%. When time is of the essence, this is the product you want.

Lending Wise

A cloud-based lending platform that helps you automate your business. The borrowers can use a cell phone to access the platforms to apply, fill-out loan docs, upload supplementals, and more. This platform allows for collaboration with multiple parties so that you can reach out to a third party when necessary. Coordinate in real-time. 100% on AWS & aligned with SOC 2, ISO 27001, & PCI compliance.

Lending QB

SaaS browser-based software. Loan compliance and fast turn-around times are guaranteed with this streamlined performance-driving software. Put yourself in front of the pack with a package of tools developed with your needs in mind, including web chat that allows you to never miss a message. Edocs make it simple to share documents, request signatures, and close out the origination paperwork fast and easy. You borrowers will love how simple it is too.

LoansPQ

This is software designed to provide a full loan product suite to banks and credit unions. It can streamline applications by consolidating paperwork, ensuring that the process is the same every time. Compliance is easier when you use LoansPQ as they ensure systems are in place to walk both you and the borrower through each step of the process, from application to loan origination and beyond. This system can handle enormous amounts of traffic and personalize to suit your business needs. Integrate several different channels such as chat, mobile apps, and various branches all into one platform that gives your borrowers a world-class experience.

Plaid

Plaid provides borrowers with an easy way to apply for loans with lenders with access to bank data. They get decisions faster, and you process loan origination documents faster too. Simply log-in and begin working. Using it with mobile applications is simple as well. You can verify the borrower’s assets digitally. Verify their identity and instantly authenticate their accounts digitally l. It’s fast, and it’s sure to help you take the wait out of lending. Did we mention that it is customizable too?

Putting the Whole Package Together

Don’t forget that you will need proper communication. After providing award-winning service to borrowers you’ve already closed on, you’ll need to funnel more potential borrowers. One way to do so is through reviews. Give current members a way to let the world know how happy they are with your credit union. This is where Podium comes in. Podium is free to start and will make life much easier when you need to network between branches, teams, and staff. Podium will help you set sales goals and share information when there is a new compliance issue or a plan for the company. Take advantage of the platform today.